Suppose The At-fault Driver Has Inadequate Learn more Insurance Policy To Cover All My Damages?

You can locate the most affordable auto insurance coverage after a DUI by obtaining quotes from numerous business. Motorists with speeding tickets will certainly see a bump up in car insurance coverage prices varying from an average of 13% to 54%, depending on the state. How much time a speeding ticket will remain on your record varies by state, but it's normally 3 to five years.

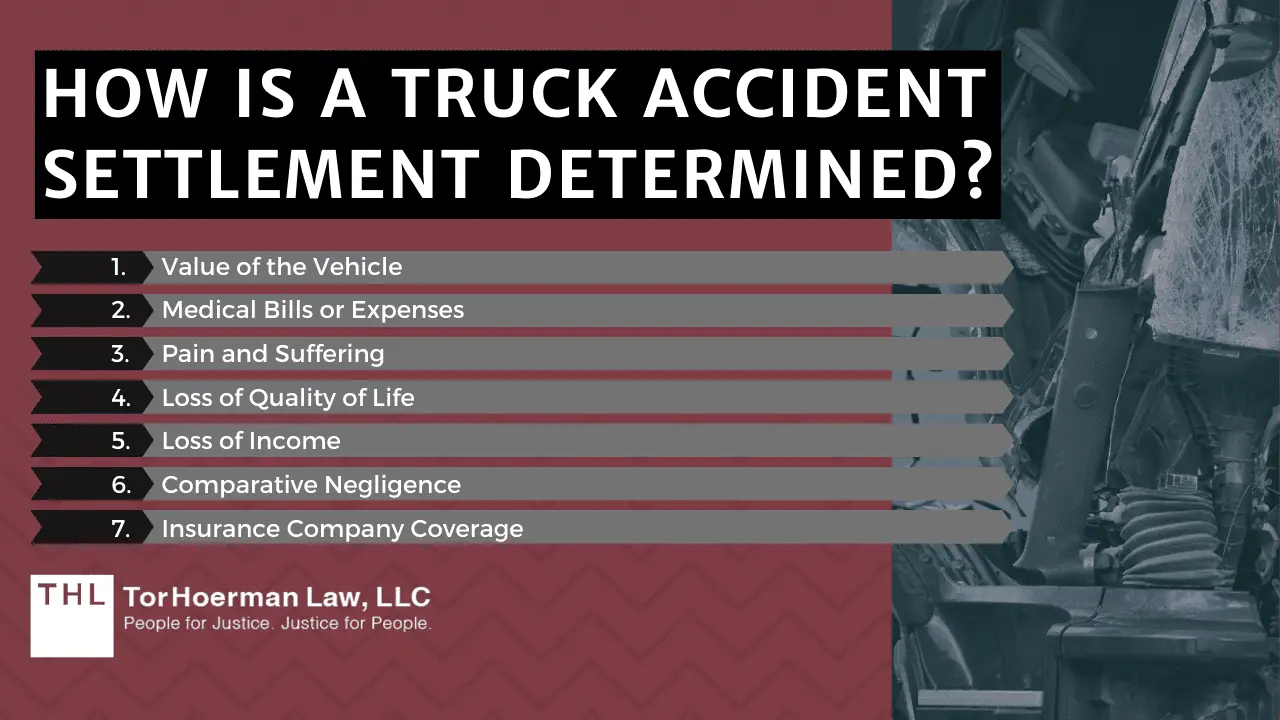

Lots of crashes involve simply two automobiles-- you and the at-fault motorist. However others can consist of numerous vehicles or numerous insurance plan. If your injuries are severe, a knowledgeable attorney can recognize policies or sources of payment.

Why Insurance Coverage Demands Matter After A Crash

This might result in high legal charges and court judgments that you'll have to pay. You might encounter permit suspension or retraction, automobile impounding, fines, and also prison time. Plus, not having insurance policy can make your prices rise when you do obtain insured Look at more info once again.

Can I Demand More Than The Insurance Coverage Limits?

- As an example, if you were hit by a commercial vehicle, an employer is frequently responsible for the negligent activities of their staff members if the activity happened in the range of their employment.If anybody is seriously damaged, medical costs can sometimes exceed $50,000 in a single day.With even more net earnings, improved coverage, and heightened awareness, both employees and employers are getting in a new era.If you have this insurance coverage on your plan, your insurance provider can cover added costs that the various other chauffeur's insurance coverage does not pay.If your injuries are keeping you from working, lost wages can be another big economic problem.

That's a 17% rate increase contrasted to a chauffeur with a clean document. The most affordable states for getting minimal insurance coverage at age 30 are Wyoming, Vermont and Iowa. Vermont, Maine, Idaho and Hawaii are the most affordable states for 30-year-olds purchasing a complete insurance coverage plan, while Florida and Louisiana set you back the most.

If you determine to sue, you could potentially recover the total of your problems directly from the at-fault chauffeur. This procedure involves showing the other vehicle driver's negligence in court and after that getting a judgment against them. It covers clinical expenditures and, in some cases, shed wages and various other problems, regardless of who created the accident.

In this last situation, you might be able to reach the business's insurance policy. But the huge thing to remember below is that collision insurance coverage will not apply to your injuries, just the cost of getting your car repaired (up to the limits of your coverage). The details supplied on this website has actually been created by Policygenius for basic informational and instructional purposes. We do our ideal to make certain that this details is updated and exact.

To address the difficulties, the victim needs to think about filing a police report, looking for compensation from their insurance plan, and possibly starting a personal injury claim. If the vehicle driver that caused the mishap does not have insurance, you may have to pay for the damages. The injured party or their insurance coverage might attempt to get money from the without insurance vehicle driver. This can create economic and legal troubles for the chauffeur, also if they weren't responsible. Recognizing if a person's policy limitations suffice to cover an accident can be very valuable as you contemplate your negotiation needs. In states that need uninsured vehicle driver coverage, you'll require it whether you have medical insurance. If your state does not require it, you could not require it if you have health insurance policy, however it deserves taking into consideration if you have a large health plan insurance deductible, copays and coinsurance. You'll require to likewise have at the very least a basic automobile insurance coverage liability policy. If your state calls for uninsured driver protection, you should purchase least the state's minimum. Your UM restriction will commonly be a quantity that matches your liability protection quantities. So, if you pick higher liability limitations, your restrictions will certainly additionally be higher.